Is your super invested the way you want?

When you joined your super, your money may have been invested into the investment option(s) you chose or defaulted to MySuper. Either way, it’s always a good idea to regularly review your super to make sure it’s meeting your retirement goals.

Before choosing where to invest, it might be worth considering:

- What do you want your super to achieve? You may want growth, to keep pace with inflation, or you may be more focused on protection of your capital raised.

- What is your desired income for your retirement?

- How long do you have or want to invest through your super?

- What is your risk tolerance and comfort with fluctuations in your super balance?

Generally, when you’re younger, your investment approach can generally be more aggressive as you have more time to ride out any losses and benefit from potentially higher returns. As you get older and approaching retirement, your strategy may change to a more conservative approach in an effort to protect your retirement savings.

Beyond considering what you want to achieve from your super, understanding the different types of investments in super and how they work, may help you decide if your current investment approach is right for you.

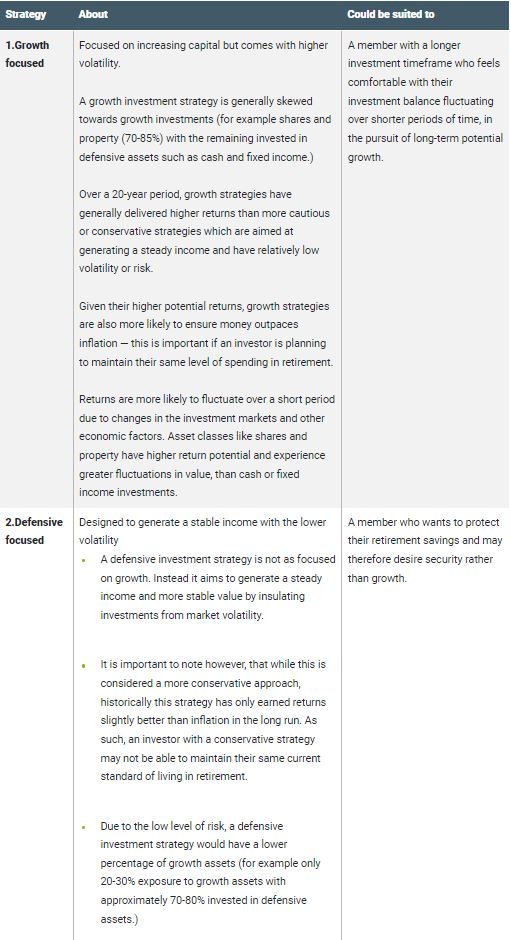

The selection of growth and defensive assets is also referred to as ‘investment strategy’. The table below broadly covers the two main investment strategies, and the type of investor they could be suited to:

An investor seeking a blend of these two strategies for more stability, with the higher risk investments targeting higher growth, and lower risk investments with less growth, may consider a ‘Balanced’ option. Designed to suit the ‘average’ super member, a balanced option is often the default investment strategy for a lot of super funds.

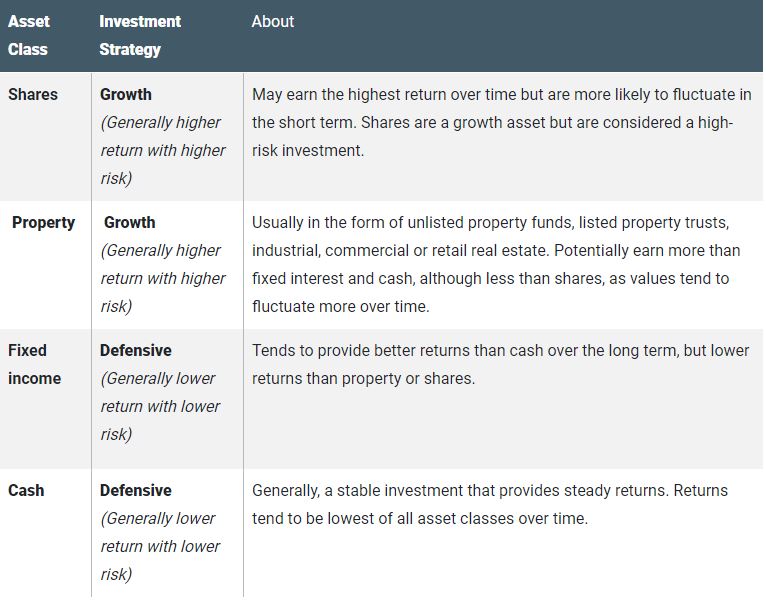

How asset classes align to these investments

The investment strategies are primarily made up of the four traditional asset classes shown in the table below:

All asset classes can suffer negative returns as investment markets are unpredictable over short periods of time. But it can be reassuring to know, the longer you invest, the more likely you are to grow your investment as fluctuations like these tend to offset through time.

How comfortable are you with risk?

Before choosing an investment option, it’s important to consider your tolerance to fluctuations, known as volatility or investment risk. How long you plan to invest your super and your comfort with short-term market fluctuations can help determine what kind of investment strategy and options may suit you.

Asset classes like shares and property have the potential to generate higher returns but generally can expose you to greater short-term fluctuations in value as opposed to defensive assets such as cash and fixed income investments. Diversifying your super across the different asset classes can help smooth out those fluctuations.

While you need to be prepared for all sorts of outcomes when investing, it’s important to understand that to grow your capital over long periods of time, you may experience some fluctuations in the value of your investment returns.

Bottom line: Understanding the different types of investments in super and how they work, can help you decide if your current investment approach is right for you.

Contact us at Smart Wealth Financial Solutions office or submit an inquiry online.

I am exceptionally happy with the quality of the advice and service that I continue to receive from Chris. Over the years I have been impressed with his breadth of knowledge and expertise, and his ability to deliver it in a simple to understand manner.